Published on 14th September, 2022

Effect of Embedded Lending on Platform Growth

Embedded lending is where lending products are offered through platforms, products, and services (i.e. food delivery apps, online marketplaces, etc). This offers a seamless lending experience to borrowers who need financing support.

With Embedded Lending

Platforms are equipped with customised tools to provide a native lending experience to users. Users can access funding directly from the platform with just a few clicks.

Loan offers to merchants are made based on platform sales data at a competitive rate with short turnaround time.

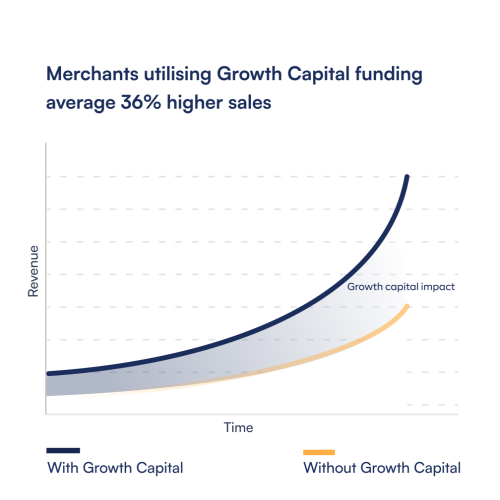

The growth potential for SMEs that utilise growth capital is massive. By offering funding options to their existing sellers to purchase inventory or invest in marketing campaigns, platforms are able to expand their services and enable native merchant growth. According to a report by Shopify Capital, merchants utilising embedded funding have been shown to average 36% higher sales than their peers.

Easy to use funding options also attract new merchants to existing platforms. Some platforms, like cloud kitchen providers, POS terminals, and some vertical SaaS, have an upfront cost for new merchants. Lending options can help ease this initial cost, thus enabling a more streamlined customer acquisition process.

Embedded lending effect on Platform Growth

Two of the biggest hurdles to platform growth are customer acquisition and customer retention. To attract new merchants and small businesses, platforms have to offer more than just another avenue for selling goods/services. Platforms should look to identify, and then solve, the biggest problems facing merchants and Small/Medium Enterprises (SMEs).

Most businesses have trouble with funding. Since 2020, record numbers of small and medium businesses have sought financing options (more than 45%), with 3 out of 4 of the aforementioned businesses looking for help with working capital and cash flow. But lately, according to a bank lending survey conducted by the European Central Bank, banks have been increasingly stricter with their lending criteria- tightening credit standards in the wake of the coronavirus pandemic.

Platforms can attract more businesses by bridging the SME financing gap. As small/medium sized businesses expand their user base on platforms, they need to scale operations to meet demand. When SMEs use their platform for funding, a stickiness is created. Merchants are incentivised to grow their businesses on the platform that provided the growth capital, as their continued source of capital is dependent on their platform’s revenue numbers.

By launching embedded lending, platforms provide high value-added offerings that reinforce the cycle of growth both for the platform and the merchants. Email hello@lenkie.com to learn more.

Sources