Published on 24th January, 2024

A Small Business Guide to Effective Vendor Management

Vendor Management: What is it and why is it important?

As a small business, accessing high-quality products and services from your vendors at fair terms is crucial to your success. This is why effective vendor management is so important. But what does it actually mean? At its core, vendor management is about cultivating and managing the relationships between your business and its suppliers.

Common vendor management issues include poor vendor selection, late payments, lack of flexibility and failure to monitor vendor performance. Any of these issues can result in strained relationships with vendors and have a negative impact on your business. Fortunately, there are various vendor management tools your business can use to overcome these challenges.

Ultimately, the goal is to cultivate strong and resilient relationships with your suppliers that will contribute to the long-term success of your business, while minimising risk. Vendor management isn't just a process; it's an investment in reliability.

Best practices in vendor management

Effective vendor management should be an ongoing process of improvement, but there are several steps you can take to best position your business for success.

Strategic vendor selection:

Conduct thorough assessments before selecting vendors. Consider factors such as reputation, financial stability, industry experience, and alignment with organisational goals. For example, selecting a vendor which simultaneously provides favourable credit terms and a quality product or service, would be a strategic fit for your business. The most successful companies thoroughly assess their vendors and ensure all vendor relationships have long-term strategic value.

Timely vendor payment:

Make timely vendor payments to build trust and foster positive relationships with suppliers. This trust is essential for maintaining a healthy and reliable supply chain, as vendors are more likely to prioritise businesses that consistently meet payment deadlines. Timely payments also allow you to negotiate favourable terms and conditions in future contracts.

Vendor audits:

Conduct periodic audits to ensure compliance with agreed-upon terms, quality standards, and regulatory requirements. For example, ensure you regularly review a vendor’s compliance with the agreed-upon terms and conditions related to pricing, payment schedules, discounts, and any penalties for late payments.

Performance-based contracts:

Consider performance-based contracts that tie vendor compensation to key performance indicators. This incentivises vendors to consistently exceed performance expectations and these contracts shift the focus from activities to outcomes. Instead of simply fulfilling tasks, vendors are incentivized to achieve measurable results.

Scalability and flexibility:

Ensure that vendor agreements are flexible to accommodate changes in your business. This includes the ability to scale up or down services and adjust contract terms as needed. For instance, if you work in the fashion industry, you can expect seasonal fluctuations in demand. Flexible vendors can quickly adjust production volumes to accommodate changes in demand for different styles, colours, or designs, helping you avoid overstock or stockouts.

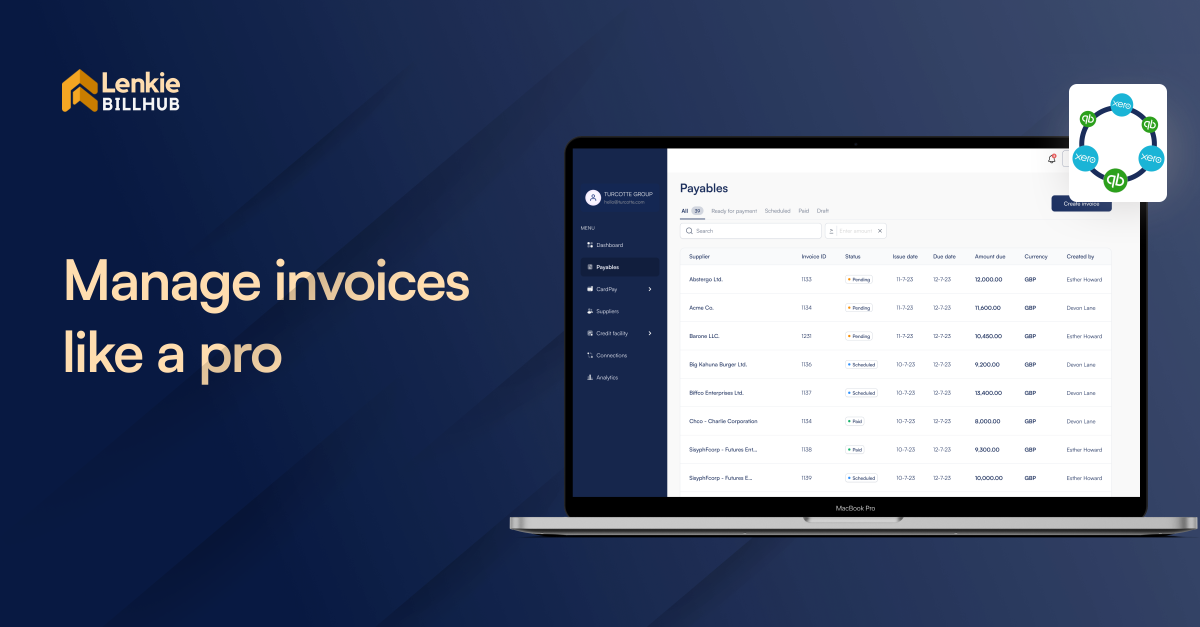

How Lenkie BillHub helps you improve vendor management

Lenkie BillHub allows you to manage, pay, and reconcile all your invoices from a single dashboard. BillHub was designed around the needs of small businesses like yours, and it offers solutions at every step of the accounts payable process that will help you with vendor management.

Manage all your vendor invoices from one dashboard

BillHub consolidates all your vendor invoices into one dashboard, giving you full visibility over all upcoming vendor payment amounts and dates. This helps to ensure timely payment of vendor invoices, which is crucial for maintaining strong relationships with suppliers. BillHub’s dashboard also makes it simple and quick to conduct periodic reviews and vendor audits.

Pay vendors with multiple payment options

With BillHub you can choose to pay vendors via Lenkie’s Credit Facility, your own credit card (even when the vendor doesn’t accept card payments), or instant bank transfer. This flexibility ensures that you can pay vendors on time even when cash flow is tight. It also allows you to purchase more volume from key vendors during your peak periods, whilst ensuring you’re using the best payment option available to you each time.

Assess vendor risk (coming soon)

BillHub’s upcoming ‘Vendor Insights’ feature will allow you to easily assess the quality and creditworthiness of vendors to find the ones that are the right fit for your business. This will help you manage third-party risk and implement strategies to improve overall supply chain resilience.

Join the growing number of businesses that are tackling their accounts payable with Lenkie BillHub. Experience the difference.