Published on 11th January, 2024

A Small Business Guide to Accounts Payable

Accounts payable: What is it and why is it important?

"Accounts payable" (or “AP”) refers to the financial obligations that a business owes to its suppliers and creditors for goods and services received but not yet paid for. It is a key component of a company's liabilities on its balance sheet.

Efficient handling of accounts payable is vital for cash flow management as it ensures optimal use of available funds, maintaining liquidity by avoiding early payments and utilising the full credit terms offered by suppliers.

Timely and accurate payment of accounts payable is also essential for maintaining good supplier relationships, as it demonstrates reliability and fosters trust, ensuring ongoing supply and potentially more favourable terms in the future.

The accounts payable process

The accounts payable process for a small business typically involves several steps to ensure that all payments to suppliers and creditors are made accurately and on time.

Receiving the invoice:

The process starts when a business receives an invoice from a supplier or vendor. This invoice details the goods or services provided, the amount due, and the payment terms.

Data entry:

Once verified, the invoice details are entered into the accounting system. This may involve manual data entry or automated systems that can scan and input data from invoices.

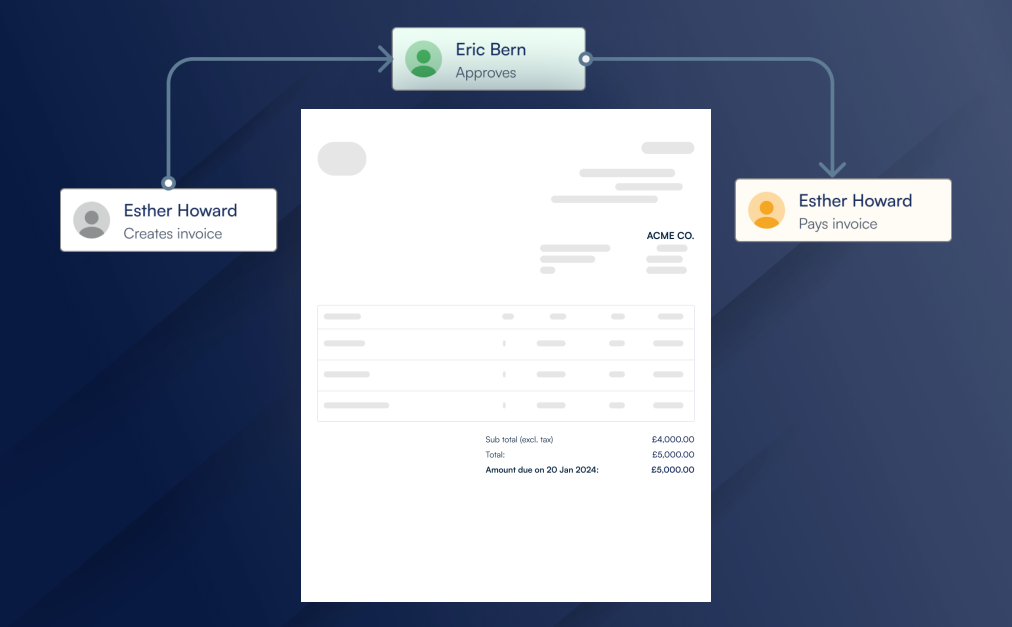

Invoice approval:

The invoice must be approved for payment. This might require the approval of the person who ordered the goods or services or a manager. In some cases, multiple levels of approval may be required depending on the amount or nature of the expense.

Scheduling payments:

After approval, the invoice is scheduled for payment. This scheduling is often influenced by the payment terms agreed upon with the supplier and the business’ cash flow situation.

Payment processing:

When the payment date arrives, the finance department processes the payment. This could be through various methods like bank transfers, checks, or online payment systems.

Reconciliation:

After payment, the transaction is recorded in the general ledger. This helps in maintaining accurate financial records and assists in reconciliation during the end of a financial period.

Challenges of a manual accounts payable process

Manual accounts payable processes can create major challenges for small businesses.

Wasted time:

A recent survey found that over 50% of businesses spend 10+ hours per week processing and paying supplier invoices. This is a crucial time that finance teams and small business owners could otherwise be spending on strategic initiatives to grow the business.

Manual errors:

Manual data entry and reconciliation frequently results in costly human errors that can result in incorrect payment amounts, inconsistent financial reporting, and damaged supplier relationships.

Lack of visibility and control:

Without an integrated AP system, managers and business owners often have poor visibility of the company’s liabilities and cash flow. This can hamper their decision-making ability and increase the risk of fraud.

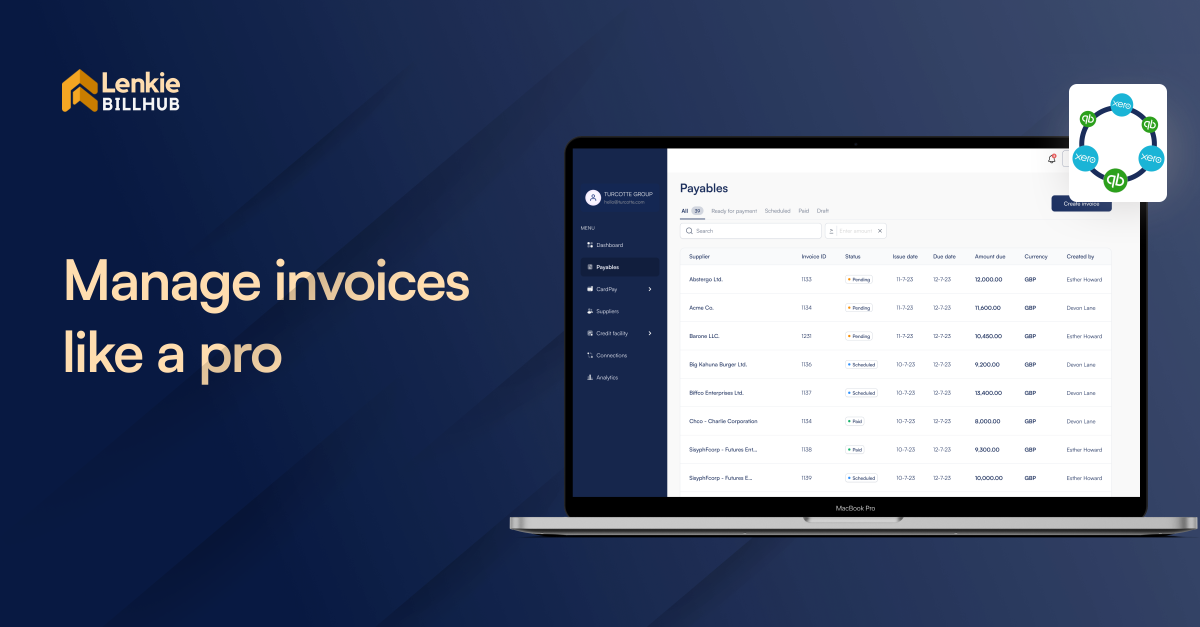

How Lenkie BillHub can streamline your accounts payable process

Lenkie BillHub allows you to manage, pay, and reconcile all your invoices from a single dashboard. BillHub was designed around the needs of small businesses like yours, and it offers solutions at every step of the accounts payable process that will save you time, money, and hassle.

Receiving the invoice:

BillHub syncs with your accounting software to automatically import invoices into a single, consolidated dashboard. You can also create invoices within BillHub or forward invoices to a dedicated email address.

Data entry:

BillHub’s automated data capture tool will save you the time and headache of manually inputting invoice data.

Invoice approval:

You can create customised authorisations and workflows for easy and efficient payment approvals.

Scheduling payments:

Simply select the date when you would like a payment to be made, and Lenkie will automatically process the payment at that time.

Payment processing:

You can proactively manage cash flow by choosing one of our three payment options: pay via Lenkie’s Credit Facility, your own credit card, or direct bank transfer. You can also process payroll or pay multiple suppliers at once using our batch payments feature.

Reconciliation:

Payments sync instantly with your accounting software for hassle-free bookkeeping that will save you time and reduce human errors.

Join the growing number of businesses that are tackling their accounts payable with Lenkie BillHub. Experience the difference today.